Futures trading is a cornerstone of the financial markets, offering participants the ability to hedge risks, speculate on future price movements, and diversify portfolios. Understanding the trading hours of futures markets is crucial for anyone involved in this dynamic field. This article delves into the specifics of futures trading hours, covering the major exchanges, key commodities, and the impact of trading hours on market activity.

See Also: Exploring the Landscape of Futures Trading on Robinhood

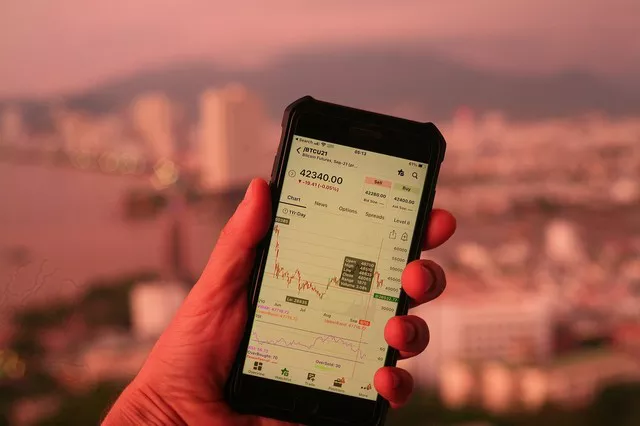

Introduction to Futures Trading

Futures contracts are agreements to buy or sell an asset at a predetermined price at a specified time in the future. These contracts are standardized and traded on futures exchanges, which provide a regulated environment for trading. Futures markets are essential for price discovery and risk management in various sectors, including agriculture, energy, metals, and financial instruments.

Major Futures Exchanges

Futures contracts are traded on several major exchanges around the world. Each exchange has its own set of trading hours, which can vary significantly. The most prominent futures exchanges include the Chicago Mercantile Exchange (CME), Intercontinental Exchange (ICE), and Eurex.

Chicago Mercantile Exchange (CME)

The CME is one of the largest and most diverse futures exchanges globally. It offers a wide range of futures products, including commodities, interest rates, equity indexes, and foreign exchange.

Trading Hours at CME

The CME operates on a nearly 24-hour basis from Sunday evening to Friday evening. This extended trading period allows participants from different time zones to engage in the market. The trading hours can be divided into two main sessions: the regular trading hours (RTH) and the extended trading hours (ETH).

Regular Trading Hours (RTH): The RTH session typically runs from 8:30 AM to 3:15 PM Central Time (CT) for most equity index futures, such as the E-mini S&P 500. These hours coincide with the New York Stock Exchange (NYSE) trading hours.

Extended Trading Hours (ETH): The ETH session covers the period outside of RTH, providing continuous trading opportunities. For example, the CME Globex platform, which supports electronic trading, operates from 5:00 PM to 4:00 PM CT the next day. This session starts on Sunday at 5:00 PM CT and runs until Friday at 4:00 PM CT, with a one-hour break each day.

Intercontinental Exchange (ICE)

The ICE is another major global futures exchange, known for its energy, agricultural, and financial futures.

Trading Hours at ICE

Similar to the CME, the ICE operates nearly 24 hours a day, accommodating global market participants.

Energy Futures: ICE’s energy futures, such as Brent Crude Oil, trade from 8:00 PM to 6:00 PM Eastern Time (ET) the next day, from Sunday to Friday.

Agricultural Futures: ICE’s agricultural futures, like coffee and cocoa, generally trade from 4:00 AM to 2:00 PM ET.

Financial Futures: Financial futures, such as ICE U.S. Dollar Index, trade from 8:00 PM to 6:00 PM ET the next day, from Sunday to Friday.

Eurex

Eurex is a leading European futures exchange, offering a wide range of products, including equity index, interest rate, and volatility futures.

Trading Hours at Eurex

Eurex operates on a similar extended schedule to cater to global traders.

Equity Index Futures: Trading typically runs from 1:10 AM to 10:00 PM Central European Time (CET).

Interest Rate Futures: These contracts generally trade from 1:10 AM to 10:00 PM CET.

Impact of Trading Hours on Market Activity

The trading hours of futures markets significantly impact market activity, liquidity, and volatility. Understanding these effects is crucial for traders and investors.

Liquidity

Liquidity refers to the ease with which an asset can be bought or sold without affecting its price. In futures markets, liquidity tends to be highest during the regular trading hours when the underlying cash markets are also open. For example, equity index futures are most liquid during the overlap with the NYSE trading hours.

Volatility

Volatility is the degree of variation in the price of a financial instrument over time. Futures markets can experience heightened volatility during certain periods, such as economic data releases or geopolitical events. Extended trading hours allow traders to react to news events outside of regular trading hours, which can increase volatility.

Arbitrage Opportunities

Arbitrage involves taking advantage of price differences between markets. The nearly continuous trading hours of futures markets provide opportunities for arbitrage between different exchanges and time zones. For instance, a trader might exploit price discrepancies between the CME and Eurex during overlapping trading hours.

Hedging and Risk Management

Futures markets play a critical role in hedging and risk management for various industries. The extended trading hours enable companies to manage their risk exposure more effectively. For example, an airline might hedge its fuel costs using crude oil futures, even during off-hours when significant price movements occur.

Electronic Trading Platforms

The advent of electronic trading platforms, such as CME Globex and ICE Futures U.S., has revolutionized the futures markets. These platforms facilitate nearly 24-hour trading, increasing accessibility and efficiency. Electronic trading has also enhanced transparency and reduced transaction costs.

Market Participants

Futures markets attract a diverse range of participants, including speculators, hedgers, arbitrageurs, and institutional investors. Each group has different trading strategies and objectives, influencing market dynamics during different trading hours.

Speculators

Speculators aim to profit from price movements in futures contracts. They are often active during periods of high volatility and liquidity. Speculators might trade during both regular and extended trading hours to capitalize on market opportunities.

Hedgers

Hedgers use futures contracts to mitigate risk. They are typically more active during regular trading hours when liquidity is higher. However, extended trading hours provide flexibility for hedgers to manage their positions in response to market developments.

Arbitrageurs

Arbitrageurs exploit price differences between related markets. They benefit from the nearly continuous trading hours, which allow them to engage in cross-market arbitrage strategies.

Institutional Investors

Institutional investors, such as pension funds and mutual funds, use futures for portfolio diversification and risk management. They tend to trade during regular trading hours but may also participate in extended sessions for strategic reasons.

Commodity Futures Trading

Commodity futures are a significant segment of the futures markets, covering products such as crude oil, gold, wheat, and coffee. Each commodity has specific trading hours that reflect the characteristics of its market.

Crude Oil Futures

Crude oil futures, including West Texas Intermediate (WTI) and Brent Crude, are among the most actively traded commodities. They have extended trading hours to accommodate the global nature of the oil market.

WTI Crude Oil Futures: Traded on the CME, WTI futures operate from 6:00 PM to 5:00 PM CT the next day, from Sunday to Friday.

Brent Crude Oil Futures: Traded on the ICE, Brent futures trade from 8:00 PM to 6:00 PM ET the next day, from Sunday to Friday.

Gold Futures

Gold futures, traded on the CME, are another popular commodity. They are used for both hedging and speculative purposes.

Gold Futures: CME gold futures trade from 6:00 PM to 5:00 PM CT the next day, from Sunday to Friday.

Agricultural Futures

Agricultural futures cover a wide range of products, including grains, livestock, and soft commodities.

Grains (e.g., Corn, Wheat, Soybeans): CME grain futures typically trade from 7:00 PM to 7:45 AM CT and from 8:30 AM to 1:20 PM CT, from Sunday to Friday.

Livestock (e.g., Live Cattle, Lean Hogs): CME livestock futures usually trade from 8:30 AM to 1:05 PM CT, Monday to Friday.

Soft Commodities (e.g., Coffee, Cocoa): ICE soft commodities have varied trading hours, generally from 4:00 AM to 2:00 PM ET.

Financial Futures Trading

Financial futures encompass interest rate, equity index, and foreign exchange futures. These contracts are critical for managing financial risk and speculative trading.

Interest Rate Futures

Interest rate futures, such as U.S. Treasury bonds and Eurodollar futures, are essential for hedging interest rate risk.

U.S. Treasury Futures: Traded on the CME, these futures typically trade from 5:00 PM to 4:00 PM CT the next day, from Sunday to Friday.

Eurodollar Futures: Also traded on the CME, Eurodollar futures operate from 5:00 PM to 4:00 PM CT the next day, from Sunday to Friday.

Equity Index Futures

Equity index futures, such as the E-mini S&P 500, are popular for hedging and speculative trading.

E-mini S&P 500: Traded on the CME, these futures trade from 5:00 PM to 4:00 PM CT the next day, from Sunday to Friday.

Foreign Exchange Futures

Foreign exchange (FX) futures provide a way to hedge and speculate on currency movements.

FX Futures: Traded on the CME, FX futures typically operate from 5:00 PM to 4:00 PM CT the next day, from Sunday to Friday.

Conclusion

Understanding the trading hours of futures markets is vital for effective participation in these markets. The nearly 24-hour trading schedule of major futures exchanges like CME, ICE, and Eurex allows for continuous market access, accommodating global participants. Trading hours impact liquidity, volatility, and market activity, influencing the strategies of different market participants, including speculators, hedgers, arbitrageurs, and institutional investors.

The extended trading hours have been facilitated by electronic trading platforms, which have enhanced market efficiency and transparency. Each category of futures, whether commodities, financial instruments, or equity indexes, has specific trading hours that reflect the characteristics of its market. By grasping the nuances of futures trading hours, traders and investors can better navigate the complexities of the futures markets and make more informed decisions.

In summary, the futures markets offer a dynamic and nearly continuous trading environment. The flexibility provided by extended trading hours enables participants to manage risk, capitalize on market opportunities, and respond to global events in real-time. Whether you are a seasoned trader or a newcomer to futures, understanding the intricacies of trading hours is a fundamental aspect of successful futures trading.