The world of futures trading is vast and complex. It involves contracts that derive their value from the performance of an underlying asset. These assets can range from commodities and currencies to financial instruments and indices. One crucial aspect of futures trading is understanding how to calculate margin requirements. This article delves into the mechanics of calculating margin for futures, providing a comprehensive guide for traders and investors alike.

See Also: How to reduce margin in Nifty futures?

Understanding Futures Margin

Before diving into calculations, it’s essential to understand what futures margin is. Unlike stocks, where margin often refers to borrowing funds to purchase shares, in futures trading, margin represents a security deposit. This deposit ensures the performance of the futures contract. There are two main types of margins in futures trading:

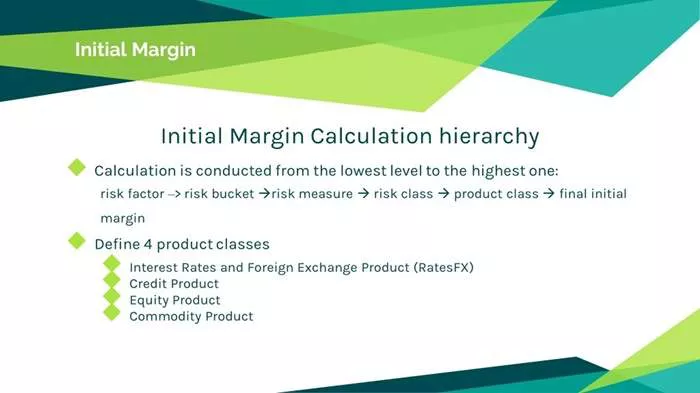

Initial Margin: This is the amount required to open a futures position.

Maintenance Margin: This is the minimum amount that must be maintained in the margin account after the position is opened.

Importance of Margin in Futures Trading

Margins serve several crucial functions in futures trading:

Risk Mitigation: Margins help mitigate the risk of default by ensuring traders have a vested interest in maintaining their positions.

Leverage Management: Futures trading often involves leverage, and margins help manage this leverage by setting aside funds that cover potential losses.

Market Stability: By requiring margins, exchanges help maintain market stability and integrity.

Components of Futures Margin Calculation

Calculating futures margin involves several components:

Contract Value: The total value of the futures contract.

Margin Requirement Percentage: The percentage of the contract value required as margin.

Price Fluctuations: Daily changes in the contract’s value can impact margin requirements.

Step-by-Step Guide to Calculating Futures Margin

Let’s break down the process into manageable steps:

- Determine the Contract Value:

The contract value is calculated by multiplying the futures price by the contract size. For example, if the futures price of a commodity is $50 per unit and the contract size is 100 units, the contract value is $50 x 100 = $5,000. - Identify the Margin Requirement Percentage:

The margin requirement percentage is set by the futures exchange and can vary depending on the contract and market conditions. For instance, if the exchange sets a 10% margin requirement, you will need to deposit 10% of the contract value. - Calculate the Initial Margin:

Multiply the contract value by the margin requirement percentage. Using our previous example with a 10% margin requirement, the initial margin would be $5,000 x 0.10 = $500. - Understand Maintenance Margin:

The maintenance margin is usually a lower percentage than the initial margin. For instance, if the maintenance margin is 6%, you would calculate it as $5,000 x 0.06 = $300. - Account for Price Fluctuations:

As the futures price fluctuates, so does the value of the contract and, consequently, the margin requirements. If the price of the commodity increases to $55, the new contract value is $55 x 100 = $5,500. The new initial margin would be $5,500 x 0.10 = $550, and the new maintenance margin would be $5,500 x 0.06 = $330.

Examples of Margin Calculations

Let’s consider a few examples to solidify the concepts.

Example 1: Gold Futures

- Futures Price: $1,800 per ounce

- Contract Size: 100 ounces

- Initial Margin Requirement: 5%

- Maintenance Margin Requirement: 3%

- Calculate Contract Value: $1,800 x 100 = $180,000

- Initial Margin: $180,000 x 0.05 = $9,000

- Maintenance Margin: $180,000 x 0.03 = $5,400

Example 2: Crude Oil Futures

- Futures Price: $70 per barrel

- Contract Size: 1,000 barrels

- Initial Margin Requirement: 8%

- Maintenance Margin Requirement: 5%

- Calculate Contract Value: $70 x 1,000 = $70,000

- Initial Margin: $70,000 x 0.08 = $5,600

- Maintenance Margin: $70,000 x 0.05 = $3,500

Dynamic Nature of Margin Requirements

It’s crucial to understand that margin requirements are not static. They can change based on market volatility, regulatory changes, and the discretion of the futures exchange. High volatility can lead to increased margin requirements, as exchanges seek to protect themselves and traders from rapid price swings that could lead to significant losses.

Margin Calls and Their Implications

When the funds in a trader’s margin account fall below the maintenance margin level, a margin call occurs. A margin call is a demand from the broker to deposit additional funds to bring the account balance up to the required maintenance margin. If the trader fails to meet the margin call, the broker has the right to liquidate the position to cover the shortfall.

Example of a Margin Call

Consider the previous example of crude oil futures. If the price drops from $70 to $65, the new contract value is $65,000. The maintenance margin would now be $65,000 x 0.05 = $3,250. If the account balance falls below this level, a margin call will be issued.

Calculating Variation Margin

Variation margin is the additional funds that must be deposited when a margin call occurs. It is calculated as the difference between the current account balance and the maintenance margin requirement.

- Current Account Balance: $3,000

- Maintenance Margin: $3,250

- Variation Margin Required: $3,250 – $3,000 = $250

The trader must deposit an additional $250 to meet the margin call.

Risk Management Strategies

Effective risk management is crucial in futures trading. Here are some strategies to consider:

- Regularly Monitor Margin Levels: Keep a close eye on margin levels and account balances to avoid margin calls.

- Diversify Positions: Diversifying your trading positions can help mitigate risk.

- Use Stop-Loss Orders: Implement stop-loss orders to automatically close positions at predetermined price levels.

- Stay Informed: Keep abreast of market news and trends that could impact futures prices and margin requirements.

Automated Margin Calculation Tools

Many brokers and trading platforms offer automated tools to calculate margin requirements. These tools can save time and reduce the risk of manual errors. They typically require inputting the contract details, and the system will calculate the initial and maintenance margins automatically.

Regulatory Framework and Margin Requirements

Different countries have varying regulatory frameworks governing futures trading and margin requirements. For example:

United States: The Commodity Futures Trading Commission (CFTC) oversees futures trading, with margin requirements set by individual exchanges like the CME Group.

European Union: Futures trading is regulated by the European Securities and Markets Authority (ESMA), with margin requirements also set by individual exchanges.

Traders must be aware of the regulatory environment in which they are operating, as it can impact margin requirements and trading strategies.

Advanced Margin Calculation Techniques

For more experienced traders, advanced techniques can be employed to manage margin requirements effectively. These include:

Portfolio Margining: This approach considers the overall risk of a trader’s portfolio, potentially reducing margin requirements by offsetting positions.

Span Margining: Standard Portfolio Analysis of Risk (SPAN) is a sophisticated algorithm used by many exchanges to calculate margin requirements based on the risk of the entire portfolio rather than individual positions.

Conclusion

Understanding how to calculate margin for futures is a fundamental skill for any trader or investor involved in the futures market. By grasping the concepts of initial and maintenance margins, and by following a systematic approach to margin calculations, traders can better manage their positions and mitigate risks.