Futures trading has gained prominence as a powerful tool for investors to speculate on price movements and manage risk across various asset classes. Zerodha, one of India’s leading discount brokerage firms, offers a platform that allows traders to participate in futures trading. However, before embarking on this journey, understanding the capital requirements is essential.

Capital Requirements: A Primer

Futures trading involves entering into contracts that obligate traders to buy or sell an underlying asset at a predetermined price on a future date. While futures trading offers leverage, allowing traders to control a larger position with a smaller amount of capital, it also entails risks. Zerodha has specific margin requirements for each futures contract, which determine the minimum amount of capital a trader needs to initiate a position.

The capital requirement for futures trading on Zerodha is influenced by various factors, including the contract’s value, market volatility, and the exchange’s margin policies. Different assets have different margin requirements due to their inherent risks and price fluctuations. For instance, trading equity index futures might require a different amount of capital compared to trading commodity futures.

Leverage and Margin Trading

Zerodha provides traders with the ability to trade futures on margin, which essentially means that traders can control larger positions with a fraction of the contract’s value. This leverage amplifies both potential profits and potential losses. While leverage can enhance gains, it also heightens the risks, making risk management a crucial aspect of futures trading.

Traders should be aware that while leverage can magnify returns, it also exposes them to the risk of losing more than their initial investment. Therefore, it’s essential to have a clear understanding of leverage and to manage position sizes accordingly to prevent excessive risk exposure.

Risk Management: A Prudent Approach

Risk management is a cornerstone of successful futures trading. Zerodha provides risk management tools to help traders safeguard their capital and make informed decisions. One such tool is the “Stop Loss” order, which allows traders to set a specific price at which their positions will be automatically sold if the market moves against them. This feature helps limit potential losses and prevent the erosion of trading capital.

Another risk management strategy is diversification. Spreading capital across different futures contracts and asset classes can mitigate the impact of adverse price movements on a single position. By diversifying their portfolio, traders can reduce the overall risk exposure and increase the likelihood of positive outcomes.

Education and Resources

Zerodha recognizes the importance of educating traders about the intricacies of futures trading. The brokerage offers educational resources, including articles, webinars, and tutorials, to help traders understand the fundamentals of futures trading, risk management strategies, and the nuances of the market.

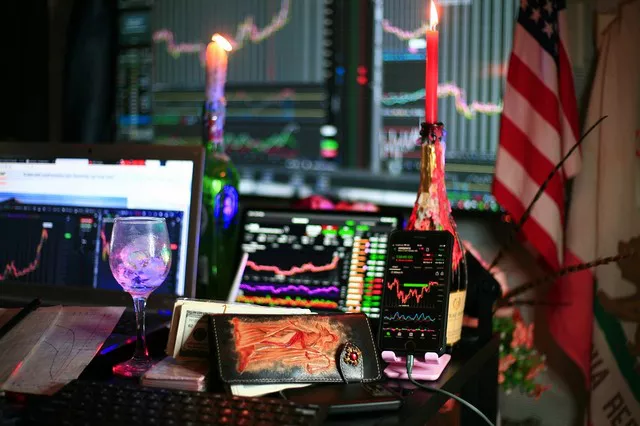

Additionally, Zerodha’s trading platform provides real-time market data, charts, technical indicators, and historical price information. Armed with these tools, traders can perform thorough analysis, develop informed trading strategies, and make well-considered decisions.

Simulation and Practice

For those new to futures trading or looking to refine their strategies, Zerodha offers paper trading or virtual trading accounts. These accounts simulate real market conditions, allowing traders to practice without risking real capital. This feature is invaluable for gaining practical experience, testing strategies, and building confidence before committing actual funds.

Account Types and Funding

Zerodha offers different types of accounts, including Regular and Commodity Trading Accounts. Traders can choose the account type that aligns with their trading preferences and the assets they wish to trade. Funding these accounts involves transferring the required capital, which can be done via online banking or other supported methods. Traders should ensure they have sufficient funds in their trading accounts to meet margin requirements and maintain positions.

Conclusion

Futures trading on Zerodha provides traders with a gateway to the dynamic world of financial markets. Capital requirements are a critical consideration, as they determine the extent to which traders can participate in this exciting realm. Leverage, risk management, education, and practical experience all play pivotal roles in navigating futures trading successfully.

Aspiring futures traders should approach this endeavor with a prudent understanding of the risks and rewards. By leveraging the resources and tools offered by Zerodha, traders can make informed decisions, manage their risk exposure, and embark on a journey of trading futures with confidence.