Embarking on the journey of trading futures can be both exciting and challenging for beginners. Futures contracts offer a unique way to engage with financial markets, providing opportunities for profit through price speculation.

Understanding the Basics of Futures Contracts

Futures contracts are financial derivatives that obligate the buyer to purchase, and the seller to sell, a specific quantity of an underlying asset at a predetermined price on a specified future date. These contracts can be based on various assets, including commodities, currencies, stock indices, and interest rates. The standardized nature of futures contracts, with fixed contract sizes and expiration dates, distinguishes them from other financial instruments. It’s crucial for beginners to grasp these basic concepts before delving into the intricacies of trading futures.

Selecting a Reliable Futures Broker

Choosing a reputable futures broker is a critical first step for beginners. A futures broker facilitates the execution of trades and provides access to the futures markets. Look for a broker with a user-friendly trading platform, competitive commission rates, and a range of educational resources. Ensure that the broker is regulated by relevant authorities to guarantee a secure and transparent trading environment. Conduct thorough research and consider the broker’s reputation, customer service, and the range of futures contracts offered.

Educating Yourself on Market Dynamics and Terminology

Before executing trades, beginners should familiarize themselves with key market dynamics and terminology associated with futures trading. Concepts such as margin, leverage, long and short positions, and order types (market orders, limit orders, stop orders) are fundamental to understanding how futures markets operate. Additionally, grasp the significance of market participants, including hedgers, speculators, and market makers, in shaping price movements.

Developing a Clear Trading Plan

Successful futures trading requires a well-defined trading plan. Begin by establishing your financial goals, risk tolerance, and the time commitment you can dedicate to trading. Outline your trading strategy, including entry and exit criteria, risk management rules, and the types of futures contracts you intend to trade. A clear and disciplined trading plan can help you navigate the emotional challenges of trading and make informed decisions based on your objectives.

Practicing with Paper Trading Accounts

For beginners, practicing without risking real capital is invaluable. Many futures brokers offer paper trading accounts, allowing you to execute simulated trades using virtual funds. Paper trading provides a risk-free environment to test your trading strategies, familiarize yourself with the trading platform, and gain confidence in your decision-making abilities. Treat the paper trading experience seriously, as it can be a valuable step in your learning journey.

Understanding Leverage and Margin Requirements

Leverage is a double-edged sword in futures trading. While it amplifies potential profits, it also increases the risk of significant losses. Beginners must comprehend the concept of leverage and its implications on trading positions. Margin requirements determine the amount of capital needed to open and maintain a futures position. It’s crucial to adhere to margin rules and implement risk management strategies to mitigate the impact of leverage on your trading account.

Analyzing Market Trends and Using Technical Analysis

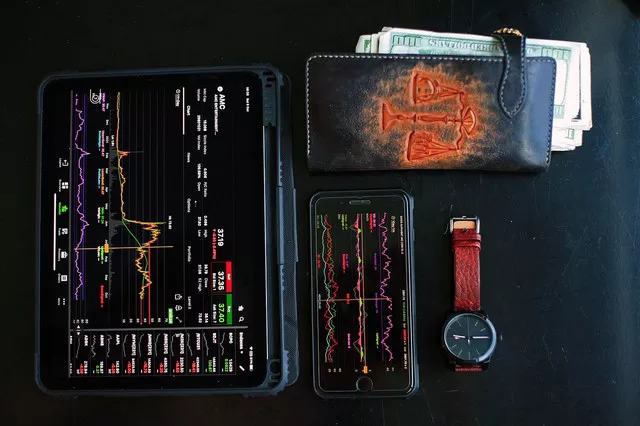

Technical analysis is a valuable tool for futures traders to analyze price trends and make informed decisions. Learn to read price charts, identify chart patterns, and use technical indicators such as moving averages, RSI, and MACD. These tools can assist in recognizing potential entry and exit points, as well as providing insights into market sentiment. A solid understanding of technical analysis enhances your ability to interpret market dynamics and make strategic trading decisions.

Staying Informed About Fundamental Analysis

In addition to technical analysis, beginners should familiarize themselves with fundamental analysis. Understand the economic factors that influence the underlying assets of futures contracts. Stay informed about relevant economic indicators, geopolitical events, and supply-demand dynamics that can impact prices. A holistic approach that combines technical and fundamental analysis provides a comprehensive view of the factors driving market movements.

Diversifying Your Portfolio with Different Futures Contracts

Diversification is a key principle in risk management. Consider diversifying your portfolio by trading a variety of futures contracts across different asset classes. This approach helps spread risk and reduces the impact of adverse movements in a single market. Explore contracts in commodities, currencies, stock indices, and interest rates to build a well-balanced and diversified futures portfolio.

Implementing Risk Management Strategies

Effective risk management is crucial for long-term success in futures trading. Determine the maximum amount of capital you are willing to risk on each trade and set stop-loss orders accordingly. Establish risk-reward ratios to ensure that potential losses are controlled relative to potential profits. Consistently applying risk management principles protects your trading capital and helps preserve your ability to participate in future trading opportunities.

Monitoring Market Conditions and Adapting to Changes

Futures markets are dynamic, and market conditions can change rapidly. Stay vigilant by regularly monitoring market news, economic releases, and any events that may impact your positions. Be prepared to adapt your trading strategy based on evolving market conditions. Flexibility and the ability to adjust to changing circumstances are essential traits for successful futures traders.

Reviewing and Analyzing Past Trades for Continuous Improvement

After executing trades, take the time to review and analyze your performance. Evaluate the success of your trades against your initial trading plan. Identify strengths and weaknesses in your decision-making process. Continuous improvement is integral to becoming a proficient futures trader. Keeping a trading journal to document your trades, including entry and exit points, reasons for the trade, and outcomes, can provide valuable insights for ongoing development.

Conclusion

In conclusion, trading futures for beginners is a journey of continuous learning and skill development. By understanding the basics of futures contracts, selecting a reliable broker, and educating yourself on market dynamics, you lay the foundation for successful trading. Developing a clear trading plan, practicing with paper trading accounts, and implementing risk management strategies contribute to building your confidence and proficiency in futures trading.

Stay informed about market trends, utilize technical and fundamental analysis, and diversify your portfolio to manage risk effectively. As you navigate the financial frontier of futures trading, remember that discipline, adaptability, and a commitment to continuous improvement are essential elements of long-term success. Embrace the learning process, stay resilient in the face of challenges, and approach futures trading with a mindset of curiosity and growth.